Linking Configurations

A link’s purpose is to provide the ability to fund spending for an expense budget line from an area other than (or in addition to) budget transactions recording adoptions, amendments, transfers in, and carry forwards of budget authority. As with building structures, levels, and allotments, linking also requires work to be done in the Advantage Design Studio before use, when a baseline structure is not sufficient. All fields in the configuration of linking are protected and self-explanatory; thus are not listed here.

Links are primarily on budget structures that are strictly expense or revenue. Structures that are both expense and revenue naturally have revenue on a budget line along with expenditures to aid in funding. The big difference between linking and a grouped expense and revenue structure is that the COA for revenue and expenditures recorded on both structures has to be the same; where with linking there are no matching COA rules unless designed into the linking development. One such edit may be that the Department codes between linked revenue budgets and expense budgets must match, but the Fund and Appropriations do not have to match.

A link can be defined to a single revenue budget amount or to multiple amounts. Multiple amounts are often used when the expense budget line should be funded by one of two revenue amounts (normally estimated and some type of actual amount). Which will contribute depends on the advanced budget constraint being used. It may be the greater or the lesser of the two. When defining a link to a calculated revenue amount, such as Total Revenue, care should be exercised in setting the pending amount rules for those amounts that make up Total Revenue. If pending increases are defined as part of Collected Earned Revenue, then a pending Cash Receipt transaction will contribute to the Total Revenue amount in addition to the Collected Earned Revenue amount. In doing so, any link established to that revenue budget line will be increased and an expense budget will give spending authority on a pending amount. The same concern does not exist when a link is defined to a stand alone budget amount.

Once built, there are places within an application where that linking setup can be seen, but without any online options. Linking setup can be seen on the multi-section page for Budget Level Update, which is found under the transition with the same name on the Budget Structure (BUDST) table. One must highlight the row of the linked budget level on the BUDST page before navigating to the Budget Level Update page. The From Link, From Buckets, To Link, and To Buckets sections display all linking setup fields.

As linking is often desired to only active revenue budget lines in order for the lines to supply spending authority, error A6826 exists to catch when a link is being created to an inactive revenue budget line. This error can have the severity reduced to warning in the event links are often established to inactive revenue budget lines that are in this state because the transaction creating them is pending final approval.

When updates to the revenue budget occur, those updates are simultaneously transferred to the expense budget line. Such revenue updates are made by revenue budget transactions, accounts receivable transactions, or any other transaction using a posting code that updates revenue budgets. If the amount in the linked amount field of a revenue budget line goes negative, the expense budget will not have budget availability taken away. This is not saying that a reduction in a revenue budget line will not reduce the linked revenues on an expense budget line, it will. What it does mean is that an expense budget line will lose budget availability if the linked revenue amount goes down towards $0.00, but it will not lose authority if the revenue budget goes negative in the linked bucket.

When spending transactions edit an expense budget line that is linked to a revenue budget line, its available amount uses a budget constraint or formula that includes the amount of linked revenue. Links are naturally defined after revenue budgets are established, when expense budget transactions are being processed. However, links can be maintained throughout the life of an expense budget line. New links will likely increase funding and the removal of links will decrease funding.

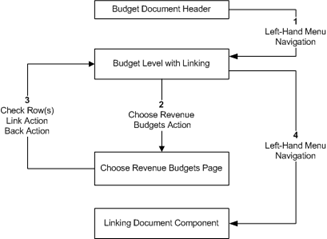

The following diagram illustrates how Budget Links are established on Expense Budget transactions.

Sample link calculationSample link calculation

|

Revenue Amount |

Floor |

Ceiling |

Percentage |

Linked Amount |

|---|---|---|---|---|

|

0.00 |

0.00 |

|

100.0000 |

0.00 |

|

100.00 |

0.00 |

|

100.0000 |

100.00 |

|

100.00 |

500.00 |

|

100.0000 |

0.00 |

|

100.00 |

20.00 |

|

100.0000 |

80.00 |

|

100.00 |

100.00 |

|

100.0000 |

0.00 |

|

100.00 |

0.00 |

75.00 |

100.0000 |

75.00 |

|

100.00 |

20.00 |

80.00 |

200.0000 |

12.00 |

|

100.00 |

20.00 |

500.00 |

50.0000 |

40.00 |

|

100.00 |

20.00 |

500.00 |

100.0000 |

80.00 |

|

100.00 |

0.00 |

|

100.00 |

0.00 |