Frequently Asked Questions

This topic contains a list of frequently asked questions and answers for the CGI Advantage HRM Tax Reporting Supplement.

W-2 and W-2C

If there are more than two items in Box 14 or more than two lines in the W2_FORM table, two form pages and one instruction page will be created in a single PDF. CGI Advantage supports printing on plain paper for W-2 forms and does not support pre-printed formats.

Yes, in DESIGNER, on the My W2 Information (MYW2INF) page, the CTEXT field can be modified.

For an employee we need to grant the Attach action in the access control settings for the Resource Group ID and security role on the SCUSER page.

According to the IRS, the original and corrected values for Box 3, Box 5, and Box 7 will populate when there is a change in any of these box values.

The recommended envelope sizes for W-2 forms are:

-

Overall size: 5-5/8" x 9"

-

Manufacturer part number: 6666-2

-

Folding technique: Center single fold (V-fold)

Note: For W-2 forms, the employer and employee addresses will appear on page 2, after the instructions.

You need to check the Descending Key Filter Parameter (DKEY) and Filter Table (FLTR) pages for the following tables and run the W-2 Tax Reporting job.

FLTR Page

|

Source Table |

Source Filter |

Target Table |

Target Filter |

|

1627 |

0004 |

1627 |

8 |

|

0532 |

0004 |

532 |

8 |

DKEY Page

|

Primary Table |

Primary Filter |

Target Table |

Target Filter |

Key Offset 1 |

Key Length 1 |

Key Type 1 |

|

1627 |

0008 |

1627 |

0 |

30 |

3 |

N |

|

0532 |

0008 |

532 |

0 |

30 |

3 |

N |

Can we run W-2 in report mode?Can we run W-2 in report mode?

We do not have a report-only option for W-2s. However, the W-2 job can be run multiple times. Each time you run the job, it will delete the data from the W2_FORM table, reload fresh data, and create new files based on the latest information.

The W-2 data is stored in the following three tables in Advantage, and is kept in BLOB format:

-

IN_OBJ_ATT_CTLG

-

IN_OBJ_ATT_STOR (This table stores the actual BLOB)

-

EMPL_TAX_FRM (This table contains records for each employee by calendar year based on internal_empl_id)

The PDFs are created either by the Create W-2 or Print W-2 jobs and are loaded using the W-2 Load job. The W2_FORM table is the input for W-2 Create/Print job.

After running the W-2 Tax Reporting job, the generated files should be compressed into a zip folder and submitted to the Social Security Administration (SSA) for federal processing. The state tax files may need to be submitted separately depending on the specific state requirements.

You need to check the DKEY page with the 1627 primary table (Table name: FICA_detl) entries. It’s likely that some data may be missing or incorrectly configured in the relevant table entries.

DKEY Page

|

Primary Table |

Primary Filter |

Target Table |

Target Filter |

Key Offset 1 |

Key Length 1 |

Key Type 1 |

|

1627 |

0008 |

1627 |

0 |

30 |

30 |

N |

Yes, you can use the following query to update the PAPERLESS_FL to N for the specific tax year provided user has admin access:

UPDATE W2_ELECTRONIC SET PAPERLESS_FL = 'N' WHERE TAX_YEAR = (the current year that needs to be changed).

Note: Always take a backup of the table before performing any updates.

The HAR9500.REPORT1 file should be available in the system's SPOOL location after the job completes successfully.

It is not mandatory to print full SSN number. The Advantage application supports SSN number masking based on the parameter given in the BIRT jobs (W-2 Create PDF and W-2C Create PDF).

As per the Print Resource Setup (IPRS) page setup:

-

If the output is set to Printer, the W-2 forms will be sent to the printer, and the PDF will be saved to a temporary path.

-

If the output is set to PDF, the PDF file will be saved to the output path configured on the Print Server Setup (IPSV) page.

Why are FICA taxes not being reported on the W-2?Why are FICA taxes not being reported on the W-2?

Before running payroll, ensure that the FICA threshold amount is updated on the Deduction Frequency field in Deduction Plan (DPLN) as per the tax year time slice. This will ensure that FICA taxes are reported correctly on the W-2.

This error can typically be resolved by moving the NFS mount point, which appears to fix the I/O error.

Always ensure that you are using the current report design form with the latest BIRT version supported by Advantage HRM.

The default directory for the W-2 Print job on the BIRT server is JETPDF/.

Ensure that you have granted the user access to the printer through the Form Printer Access Control (FPAC) page.

You need to update the SPAR W2 ELECTRONIC PIVOT DATE with the current date (DDMM) format to reflect the change for separated employees.

Where does the W-2 Print job produce PDFs?Where does the W-2 Print job produce PDFs?

The PDFs are generated in the following default path, regardless of what is specified in the job parameter:

/birt/ProcessingCenter/Main/output

-

If the PDF_NAME parameter is set to N, the PDFs are generated in this default location.

-

If the PDF_NAME parameter is set to Y, the PDFs will be saved to the following location, aligned with the job parameter: /birt/ProcessingCenter/Main/output/JETPDF.

-

If the W-2 Print Job uses the W2_FORM table and the PDF_NAME parameter is set to N, the file name will be: W2_INTERNALCONTROLNUMBER

-

If the W-2 Print Job uses the W2_FORM table and the PDF_NAME parameter is set to Y, the file name will be: PAYLOCATION_LASTNAME_INTERNALEMPLOYEEID_FEDERALTAXID

Follow these steps:

-

Log in as the employee and navigate to MEIPAY.

-

Under Manage My W-2, there is a drop-down to opt for the electronic W-2 option.

Ensure that the STATE WITH TAPE RS RECORD SPAR (that was present in version 3x) has been removed in 4x version. Check and run the job again to ensure the data is correctly reported.

To correct this issue and generate a W-2C, follow these steps:

-

Issue the check to the employee for the year (e.g., 2022).

-

Run the W-2 Tax Reporting job for that year (e.g., 2022).

-

Run the W-2C Tax Reporting job in I (Initial Load) mode.

-

Cancel the 2022 check and run the No Pay Calculation cycle.

-

Create an IRS Trigger (W2TG) for the employee.

-

Run the W-2 Tax Reporting job with the year (e.g., Y2022).

-

Run the W-2C Zero Tax Reporting job and verify the W2C_FORM table.

-

Finally, run the W-2C Tax Reporting job in R (Regular Load Run) mode.

For election workers, ensure that the Social Security and Medicare deductions are updated with the correct Deduction Plan (DPLN) Amount/Percent 1 based on the current election workers’ threshold. Then, run the W-2 Tax Reporting job for the election worker employees. Additionally, ensure that the ELECTION WORKER STATUS Site Specific Parameter (SPAR) entry Text Value matches the employee’s employment status.

Yes, Advantage allows users to print hard copies of W-2 forms for former employees who previously opted for an electronic W-2. When the Print ACA and W-2 Forms check box on the Employment Status (EMPS) page is checked and the W-2 Print job is processed for an employee with this EMPS status, the application will override the employee's W-2 electronic selection and generate hard copies of the W-2 form.

When the W-2C Tax Reporting job is executed in I (Initial Load) mode, this does not update the W2C_FORM table. The W2C_FORM table will only be updated when the job is run with R (Regular Load Run) mode.

When does the W-2 Tax Reporting job fail?When does the W-2 Tax Reporting job fail?

-

The W-2 Tax Reporting job can fail due to bad data in the EMPL_ASGNMT table. Specifically, the INTERNAL_JOBN_NO field should be NULL. If this field contains invalid or empty values, the job will fail. To fix this, follow these steps:

-

Backup the EMPL_ASGNMT table.

-

Run the following SQL update statement with admin user:

UPDATE EMPL_ASGNMT SET INTERNAL_JOBN_NO = NULL WHERE INTERNAL_JOBN_NO = '';

-

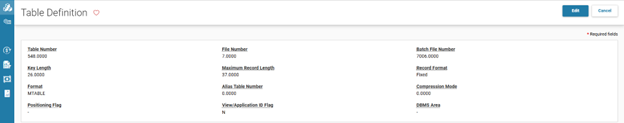

If the W-2 Tax Reporting job fails with the error message: X9100 SYSERR--DBIO7006 CALL FAILURE, follow these steps to resolve it:

-

On the Table Definition (TDEF) page, change the configuration for table number '548'. Set the Batch File Number to '7006.0000'.

-

After making this change, run the Begin Day job in ONLINE mode.

-

Then, run the W-2 Tax Reporting job again.

-

Need to check the FLTR page with source table 0667 and 0575, If it’s not present add below entry

FLTR Page

|

Source Table |

Source Table |

Target Table |

Target Filter |

|---|---|---|---|

|

0677 |

0006 |

677 |

|

|

0575 |

0006 |

575 |

This issue is typically caused by an incorrect path in the job parameters. Ensure that the PRINT_RSRC_PDF value is set correctly in the job parameters: JETPDF/W2/CreatePDF.

This error occurs because the SPAR W2PDF APPSERVER FILE LOC parameter is not set up correctly. Ensure that the value for this parameter is set to Yes, and the directory path is: apps/CGIADV/RTFiles/hr/Temp/.

Why is the W-2 PDF load job failing?Why is the W-2 PDF load job failing?

The job is failing because the UNUM sequence number is not set to a higher value than the current one. Update the UNUM sequence number in the table to a higher value, and the job should run successfully.

This error is typically caused by an incorrect path in the job parameters. Ensure that the PRINT_RSRC_PDF value is set to: JETPDF/W2/CreatePDF in the job parameters.

This error occurs due to an issue with the path in the job parameters. Make sure the PRINT_RSRC_PDF value is correctly set to:

JETPDF/W2/CreatePDF in the job parameters.

The correct combinations for APPL_RSRC_ID and PRNT_JOB_CD are:

-

APPL_RSRC_ID = "W2_FORM" with PRNT_JOB_CD = "W2_FORM"

-

APPL_RSRC_ID = "W2PDF" with PRNT_JOB_CD = "W2PDF_FORM"

Note: Currently we do not support pre-printed forms for W-2,

941

If employees do not have COVID FICA deductions, the Covid FICA Deduction Category parameter in Quarterly Summary Reporting job should be blank.

The Quarterly Summary Preprocessor job needs to be run before running the Quarterly Summary Reporting job.

Verify the Descending Key Filter Parameter (DKEY) page and Filter Table (FLTR) page should have entries for table 1625 in the application.

1099R

Employee Address (ADDR) configuration is mandatory for the 1099-R Tax Reporting job to process employees. Please confirm the employees have a valid address.