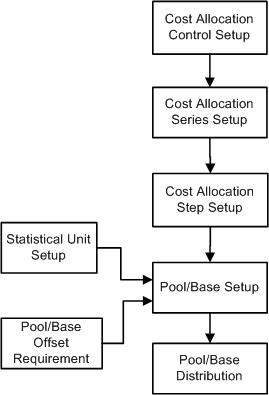

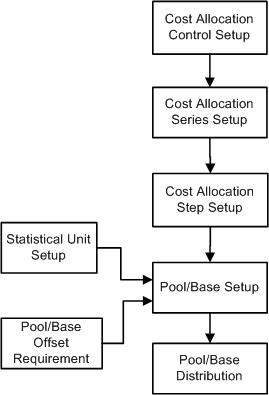

There are seven Cost Allocation Setup tables. The hierarchical structure illustrated below represents the parent-child structure that exists behind the scenes.

The Cost Allocation setup involves a hierarchical structure to be defined. At the highest level is a control record. Each control record is identified by a unique allocation identifier. That control record must be identified as an allocation of either expenditures or revenues. Multiple control records can be set up in the system for both expenditures and revenues. You may want to separate the allocation of different categories of expenditures.

The next step in Cost Allocation Setup is the Series record. Multiple series can be defined for any given allocation of expenditures. If you wish to allocate multiple groups or series of expenditures within one run of the Cost Allocation Process, then those groups can be specified at this level in the hierarchy.

The next step in the initial setup is the creation of step records within each allocation series. At least one step is required for the allocation process to run correctly. Multiple steps can be defined within an allocation. Forward reference steps can be identified if costs or revenues that are allocated in one step are to be re-distributed in a future or 'forward’ step. The concept of forward referencing is explained in greater detail in the Cost Allocation Process section.

Bases are the recipient accounting distributions in the Cost Allocation Process. Base Type must be defined at the step level. There are four options available. Each option represents a method for calculating each base record’s allocation percentage:

Fixed Percentage: The allocation percentage is defined at the setup stage for all base records.

Statistical: The allocation percentage is calculated during the allocation process based on the statistical units defined at the setup level for each base record. See Base Accumulation in the Cost Allocation Process section.

Direct Financial: The allocation percentage is calculated based on dollars accumulated in base 'accumulation’ distributions. The accumulated dollars represent the statistical unit for each base record. See Base Accumulation in the Cost Allocation Process section for more detail and examples.

Direct and In-stream Financial: This is a variation on the Direct Financial method. See Base Accumulation and Compute Allocations in the Cost Allocation Process section for more detail and examples.

For each of the three initial setup tables, pool/base inheritance must be defined for each of the chart of account elements. The inheritance type is used to define the source of COA elements for the allocation. The source may either be Pool or Base. Pool/base inheritance is best explained by looking at a single chart of account element, for example, Fund.

Pool Inheritance: If indirect costs are initially recorded to Pool A where Fund = 'A’, then the indirect costs for this accounting distribution will be allocated to another base accounting distribution where Fund = 'A’. In other words, where a chart of account element is set up with Pool Inheritance, then the costs or revenues will not be re-allocated to another value for that chart of account element. Most allocations will be set up so that the majority of chart of account elements are set to 'pool’ inheritance.

Base Inheritance: If indirect costs are initially recorded to Pool A where Fund = 'A’, then the indirect costs for this accounting distribution will be allocated to another base accounting distribution where Fund is not 'A’. Cost Allocation involves the re-distribution of costs or revenues to an accounting distribution that is different from the original distribution. For this to occur, at least one chart of account (COA) element must be set up with 'base’ inheritance.

The Cost Allocation Process will read each COA Inheritance Type from one of the three setup tables. To illustrate, Major Program can be used as an example:

The Cost Allocation Process will first read the inheritance type setting on Cost Allocation Step setup. If the value is 'pool’ or 'base’, then the process will assume that value for the allocation.

If the Cost Allocation Step setup value is 'default’, then the process must look to the inheritance type setting on Cost Allocation Series setup. If the value is 'pool’ or 'base’ on the allocation series table, then the process will assume that value for the allocation.

If both the Cost Allocation Step setup and Cost Allocation Series setup values are 'default’, then the process must look to the inheritance type setting on Cost Allocation Control setup. There is no default option on the allocation control table, so the value must be 'pool’ or 'base’. The process will assume that value for the allocation.

Pools and bases are initially defined on the Pool/Base Setup table. The key to this table includes Cost Allocation ID, Series ID and Step ID so that the user is aware that the pools and bases are being associated with an allocation step. Pool records specify the source accounting distributions that contain the costs to be allocated to different distributions (bases). Base records specify the destination accounting distributions in which pooled costs will be allocated. At least one pool is required before a base record can be defined for a step. Otherwise there is no source for an allocation. Multiple pools and bases can be defined for any step, each pool and base being uniquely identified by a system-generated pool/base sequence number.

All pool records should be set up with an allocation percentage of 100%. Depending on base type, the allocation percentages for each base record may or may not be defined also. If the base type = Fixed Percentage, then the allocation percentage for each base in the step must be defined. The sum of the allocation percentages for all bases in a single step should equal 100%.

For steps where the base type = 'Statistical’, the allocation percentage cannot be defined at setup time. Instead, the allocation percentages are calculated during the Cost Allocation Process. For this base type, statistical records must first be created on the Statistical Unit table. Users are required to enter the Statistical Group and Record ID. The Statistical Units are automatically inferred from the Statistical Unit Setup table. The Pool/Base Setup table is linked to the Statistical Setup table so that if there is a change to a record on the latter table, then the Statistical Unit value is automatically updated on Pool/Base Setup. The technical term for this relationship is that Pool/Base Setup’s Statistical Unit field is a 'maintained’ replicate from the same field on the Statistical Unit table.

For steps where the base type = 'Direct Financial’ or 'Direct and Instream Financial’, both the allocation percentage and statistical unit fields must be left blank at the time of initial setup. For all base types except Fixed Percentage, the allocation percentage for base records will be calculated during the Cost Allocation Process.

On the Pool/Base Setup table, an entry can be selected as an Offset Entry. For offset entries, an associated Offset ID is required to identify which COA elements are Required, Optional, or Prohibited when establishing the COA elements on the Pool/Base Distribution table for offset entries. The Offset ID can be created in Pool / Base Offset Requirement Table.

The final step in the setup process is Pool/Base Distribution. There are three distribution types:

Accounting Distributions: One accounting distribution must be defined for each pool and base record. Complete distributions are not required. In most cases, you will only define the elements that are being allocated. For example, in a simple case you may decide to enter a Program code for both pool and base distributions to represent the fact that all costs initially recorded to the pool program are being distributed across multiple programs. This process is described in more detail in the Cost Allocation Process section.

Accumulation Distributions: For base types “Direct Financial” or “Direct and Instream Financial”, accumulation records should be defined for base records in addition to Accounting Distribution. Allocation percentages are calculated based on the accumulated costs or revenues which are calculated by accumulating the dollars for distributions specified in Accumulation Distribution for the base record. This process is defined in more detail in the Cost Allocation Process section.

Offset Distributions: This distribution type may only be defined for pool records. This functionality is not used much in practice. This distribution comes into play during the output process. On generated output documents, the pool accounting distribution can be overwritten with the offset distribution, even though the allocation actually took place based on the original accounting distribution.

The following diagram represents an example of a complete allocation setup.

Note: Accumulation Distributions are only allowed where the Base Type = Direct Financial or Direct and In-stream Financial.