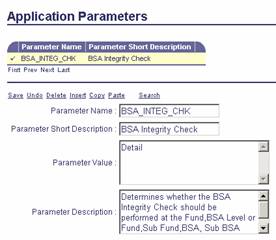

The data on these three tables may be used for online inquiry or for reporting purposes. The BBALD and BBALS tables also provide an opportunity for control. The BSA reference table contains a Level of Balance Control field that allows a control level: no error, warning, override, or reject that will be used during document validation. A parameter on the Application Parameters (APPCTRL) table decides the level (Summary or Detail) on which the balance control edit is performed. That parameter is called BSA Integrity Check (shown below).

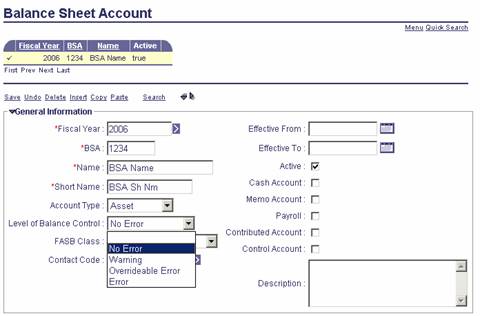

The control evaluates by Account Type, found on the BSA table. Asset accounts must maintain a debit balance while all other types of accounts must maintain a credit balance. Zero balances are viewed as the correct type of balance. For example, an asset account resulting in a credit balance because of an accounting document, will then issue an error if the Balance Sheet Account (BSA) reference table for that BSA and Fiscal Year used has a Level of Balance Control other than No Error. The level of that error issued will match the value set on that Level of Balance Control on the BSA table (shown below).

Another major use of the BBALS table data is to facilitate the flexible definition of what BSA accounts comprise the Fund Balance and Cash Balance amounts found on the other two types of accounting control tables - Fund Balance Detail (FBALDQ), Fund Balance Summary (FBALSQ), Cash Balance Detail (CBALDQ), and Cash Balance Summary (CBALSQ). More information is given on how BBALS records are linked to these types of control tables in specific sections for those tables.