The creation of records on the Fund Balance Detail Maintenance (FBALS) table will be created automatically by the application the first time a Fund and Sub Fund combination is used with a posting code that is defined as FBAL. Such a system-generated record will assume default values for all fields and will be just for tracking and not controlling. When controlling is desired, records should be setup before usage begins. However, controlling can be turned on or off later without systems assurance problems.

Data entry on this table is only required if the Balance Control on Fund Balance Detail Maintenance (FBALD) is Summary. If that setting is Detail, then FBALS is not used.

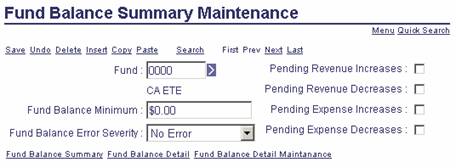

Below is a sample of a FBALS record to demonstrate the level of detail and the amount of information displayed. The hyperlinks at the bottom take a user to different inquiry pages and perform an automatic search with the values of the selected record.

|

Field Name |

Field Description |

|

Fund |

A required field for the Fund of a summary maintenance record. There is no validation of this value on this table; however, only valid Fund codes can be used on documents. |

|

Fund Short Name |

The application will infer the short name for the Fund code as defined on the FUND table for the current Fiscal Year. If the Fund is not valid in the current year, then no name will be displayed. |

|

Fund Balance Minimum |

An optional amount to define a minimum threshold of available Fund that should not be exceeded. The default for the field is $0.00 and negative amounts are allowed. |

|

Fund Balance Error Severity |

A setting that controls the level of error issued when Fund availability has been exceeded. Choices include: No Error (default), Warning, Overrideable Error, and Reject. |

|

Pending Revenue Increases |

A flag to indicate if an amount that will eventually increase (credit) a fund’s equity balance account from a document in the Pending document phase should increase Available Fund Balance. A Cash Receipt and the seller portion of an Internal Exchange Transaction are two such examples. Checked or not, such documents will still update the Pending Revenue Increases. |

|

Pending Revenue Decreases |

A flag to indicate if an amount that will eventually decrease (debit) a fund’s equity balance account from a document in the Pending document phase should decrease Available Fund Balance. A negative Cash Receipt is an example of such a document. Checked or not, such documents will still update the Pending Revenue Decreases. |

|

Pending Expense Increases |

A flag to indicate if an amount that will eventually decrease (debit) a fund’s equity balance account from a document in the Pending document phase should decrease Available Fund Balance. A Payment Request and the buyer portion of an Internal Exchange Transaction are two such examples. Checked or not, such documents will still update the Pending Expense Increases. |

|

Pending Expense Decreases |

A flag to indicate if an amount that will eventually increase (credit) a fund’s equity balance account from a document in the Pending document phase should increase Available Fund Balance. A credit memo Payment Request and the seller portion of an Internal Exchange Transaction are two such examples. Checked or not, such documents will still update the Pending Revenue Decreases. |