Many document codes in the Payroll (PYRL) document type use this table to determine the appropriate event type based on the document code created by the payroll interface and several other payroll options. Those document codes that can only perform one event type do not use this specialty table, but rather rely on the Default Event Type field on the Document Control (DCTRL) table. The default from the Payroll Event Type Defaults will only happen when the event type field is not populated on the payroll document accounting line and the determining factors match a default record. If no match, then no event type will default from this table (the document will then reject unless the Default Event Type field on the Document Control table supplied an event type). If an event type already exists on the PYRL accounting line, then no defaulting or editing will occur from the Payroll Event Type Defaults table. This table does not function as a combination validation table, which will allow the selection of a different event type on the payroll document from that of the matching table record. However, this event is very uncommon given the security in place to ensure financial records match HR records which will prevent many users from having edit, modify, or cancel access to the payroll document codes.

Records are delivered on the Payroll Event Type Defaults table to support the payroll accounting entries necessary from CGI Advantage HR. Any single implementation will not likely use all records on this table. New records added on client site is not a common occurrence unless modifications have been done to Financial, HR, and the interface program (Payroll Accounting Management - PAM).

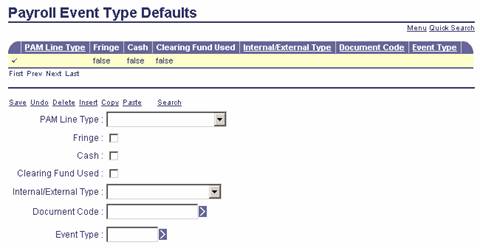

The fields on the Payroll Event Type Defaults (PYRLETD) table are as follows:

|

Field Name |

Field Description |

|

PAM Line Type |

A required field for one of these valid choices: Cancellation, Expenditure, Refund, Liability, Net Pay, Payout from Reserve, Reserve Pay, and Cross Year Cancellation. All seven choices can be used for any document code on the PYRLETD table, but many will not lead to any defaulting of event type as PAM records only certain types of payroll activity on certain document codes. The PYRLETD table is delivered with all values populated by PAM for each document code. The following is a list of what each line type means in accounting terms and the document or documents used to record the type. The document codes mentioned are only the delivered ones that can change, but if changed the Document Sub type should equal the value shown.

|

|

Fringe |

The Fringe flag on the accounting line of the Payroll document type will be set to Yes by the Payroll Account Management or other interface, indicating that the accounting line is for a fringe cost. Interfaces will set it to NO for other types of payroll costs. Whether the flag is set to Yes or No on the accounting line, the application requires a matching PYRLETD record to default the correct event type. Records for deductions and fringe costs on the Payroll Event Type Defaults table often only differ on this single field for a Document Code, PAM Line Type, and Internal/External Type. Postings are driven not by the flag, but by the event type associated with the flag, so accurate data setup on the PYRLETD is critical. |

|

Cash |

The Cash flag on the accounting line of the Payroll document type will be set to Yes by the Payroll Account Management or other interface, indicating that the two-party accounting should use cash as an offset. If set to No, then offsets will be created using the clearing accounts - Due To and Due From Fund. Whether the flag is set to Yes or No on the accounting line, the application requires a matching PYRLETD record to default the correct event type. Postings are driven not by the flag, but by the event type associated with the flag, so accurate data setup on the PYRLETD is critical. |

|

Clearing Fund Used |

Unlike the Fringe and Cash flags, the Payroll document type does not contain a Clearing Fund flag, but rather contains fields for a Clearing Fund and Sub Fund. One or both of these fields are populated when HR is setup to record a certain type of payroll cost through a clearing fund. Matching to the PYRLETD table is based on the Clearing Fund field. When it is populated, the table match for a selected Clearing Fund Used flag has to be found. When not populated, the table match must have the Clearing Fund Used flag not selected. Records with the Clearing Fund Used flag checked will resemble other Payroll Event Type Defaults table records with that flag as the only difference. It is not the flag or the population of the Payroll Clearing Fund value that drives the postings but the event type set to default that will contain postings for the employee's fund as well as the clearing fund, so accurate data setup on the PYRLETD table is critical. |

|

Internal/External Type |

A required field on the accounting line of the Payroll document that is set by the Payroll Account Management or other interface to one of six choices based on HR setup that determines if the deduction or fringe liability is owed to an external vendor or is internally funded. The value of External is used when a request to an external vendor is automatically made with a Payroll Vendor Payment Request (PRLVP). The same value is also used when the liability is recorded into the employee's fund or the Payroll Clearing Fund with a Payroll Liability (PRLIA) document and left for a later manual request for payment. Values of Inter Fund Revenue, Intra Fund Revenue, Inter Fund Expenditure, Intra Fund Expenditure, or Liabilities Only are used when the deduction or fringe is funded internally by another entity on the same CGI Advantage Financial application. The terms Inter and Intra are used to signify that the Fund/Sub Fund value for the employee is different or the same for the internal source, respectively. When funds are different, it is common to use a default event type that uses clearing accounts instead of cash as the offsets. However, if both funds involved the use of the same bank account, then an event type that offsets with cash can be used. If the funds are the same, it is common to use cash as the offset for both parties, or to use no offsets. To use cash as an offset, but have different banks would require a transfer of cash between actual banks. Minus the Inter and Intra concepts, there are three ways to fund internal deductions or fringe. In each case, the non-offset entry is the same for the employee's fund - reduction in the generic payroll liability account. For the internal fund, the non-offset can either be to a revenue account, a reduction to an expenditure account, or the establishment of a specific liability account. Postings are not dependent on the Internal/External Type values found on the PYRL document, but rather on the default event type established on the PYRLETD table matching the settings of the accounting line. For this reason, setup of the PYRLETD table is critical to achieve the desired results. |

|

Document Code |

A required field to specify one of the document codes for the Payroll (PYRL) document type from the Document Control (DCTRL) table. Document codes for the PYRL document type are only allowed to be specified. |

|

Event Type |

A required field for a default event type as defined on the Event Type (ETYP) table. Any event type associated with a document code must be valid for that document code on the Allowed Event Types for Document Code (AETDC) table. The value in this field is defaulted to a payroll document when that document does not contain an event type. |