Field Name |

Field Description |

Accept Overage Amount |

The amount up to which a referencing document’s accounting line can exceed the referenced document’s accounting line without invoking the tolerance control. Differences equal to or above the Accept Overage Amount might result in the invocation of a tolerance control or further tolerance testing if either a Reject Overage Percentage or Reject Overage Amount is defined. Use of the Accept Overage Amount is to define a dollar amount that is over ’but close enough’ not to cause rejection of the referencing document. The amount cannot be negative and cannot be greater than the Reject Overage Amount. A $10 Accept Overage on a Payment Request reference to a Purchase Order would be an example of such a tolerance. Such an amount should be applicable in most instances, except when a referenced accounting line is for a high dollar amount. Then if the Purchase Order is $100,000 and over-referenced by $25, a Reject Percentage should be available to evaluate such a reference, unless it is a hard and fast rule that $10 over is the limit. |

Reject Overage Percentage |

The percentage used to calculate the difference between the referencing and referenced accounting lines not by dollars but by a percentage over the referenced document line. Differences below the reject overage percentage might result in the invocation of a tolerance control if a Reject Overage Amount is defined and exceeded. Otherwise, if less than the percentage calculation then there is no tolerance violation, but if equal to or greater than the percentage calculation it will result in an error. Use of the Reject Overage Percentage is to define a percentage is over ’but close enough’ not to cause rejection of the referencing document. That percentage cannot be negative. Use of such a control can be used with or in substitute of the $10 Accept Overage Amount described in the earlier field. When used in conjunction with the Accept Overage Amount, if the reference violates the Accept Overage Amount but not the Reject Overage Percentage, then no error will be thrown, unless the Reject Overage Amount is violated. |

Reject Overage Amount |

The amount up to which a referencing document’s accounting line can exceed the referenced document’s accounting line that will not invoke the tolerance control. There is no further tolerance testing if the Reject Overage Amount is exceeded as the Reject Overage Percentage rule does not apply when the amount calculated for the percentage equals or exceeds the Reject Overage Amount. Use of this amount is to define the dollar amount which an over-reference will not be allowed. When used in conjunction with a Reject Overage Percentage, this amount will cap the calculation of the Reject Overage Percentage amount. The amount cannot be negative and cannot be less than the Reject Overage Amount. |

Accept Underage Amount |

The amount up to which a referencing document’s accounting line can be less than the referenced document’s accounting line without invoking the tolerance control. Differences equal to or less than the Accept Underage Amount might result in the invocation of a tolerance control or further tolerance testing if either a Reject Underage Percentage or Reject Underage Amount is defined. Use of the Accept Underage Amount is to define a dollar amount that is under ’but close enough’ not to cause rejection of the referencing document. The amount cannot be negative and cannot be greater than the Reject Underage Amount. A $10 Accept Underage on a Payment Request reference to a Purchase Order would be an example of such a tolerance to prevent the closing of Purchase Orders when ten or more dollars would still be open if a Partial Reference were performed. Such an amount should be applicable in most instances, except when a referenced accounting line is for a high dollar amount. Then if the Purchase Order is $100,000 and under-referenced by $25, a Reject Percentage should be available to evaluate such a reference, unless it is a hard and fast rule that $10 under was the limit. |

Reject Underage Percentage |

The percentage used to calculate the difference between the referencing and referenced accounting lines not by dollars but by a percentage under the referenced document line. Differences below the reject underage percentage might result in the invocation of a tolerance control if a Reject Underage Amount is defined and exceeded. Otherwise, if less than the percentage calculation then there is no tolerance violation, but if equal to or greater than the percentage calculation it will result in an error. Use of the Reject Underage Percentage is to define a percentage is under ’but close enough’ not to cause rejection of the referencing document. That percentage cannot be negative. Use of such a control can be used with or in substitute of the $10 Accept Underage Amount described in the earlier field. When used in conjunction with the Accept Underage Amount, if the reference violates the Accept Underage Amount but not the Reject Underage Percentage, then no error will be thrown, unless the Reject Underage Amount is violated. |

Reject Underage Amount |

The amount up to which a referencing document’s accounting line can be below the referenced document’s accounting line that will not invoke the tolerance control. There is no further tolerance testing if the Reject Underage Amount is exceeded as the Reject Overage Percentage rule does not apply when the amount calculated for the percentage equals or exceeds the Reject Underage Amount. Use of this amount is to define the dollar amount which an over-reference will not be allowed. When used in conjunction with a Reject Underage Percentage, this amount will cap the calculation of the Reject Underage Percentage amount. The amount cannot be negative and cannot be less than the Reject Underage Amount. |

Below is an example of a tolerance established that will demonstrate when errors are issued and when processing is allowed.

Any one of the three tolerance tables has the following values:

Accept Overage Amount: $5.01

Reject Overage Percentage: 10.0000%

Reject Overage Amount: $500.00

Accept Underage Amount: $5.01

Reject Underage Percentage: 10.0000%

Reject Underage Amount: $19.99

A referenced line was processed for $100. One referencing line has already been processed that partially closed the $100 line for $60. In all cases below, a 2nd referencing document is being validated with a reference type of final.

2nd Referencing Document |

|

Amount |

Tolerance Edit |

20.01 |

Error for Reject Underage Amount as the $19.99 underage is equal to the Reject Underage Amount of $19.99 |

20.02 |

Error for Reject Underage Percentage as the $19.98 underage is greater than the calculated amount for Reject Underage Percentage of $10 but less than the Reject Underage Amount of $19.99. |

$45.01 |

Would be an error as a $5.01 overage is equal to the Accept Overage Amount but $5.01 is less than the calculation for Reject Overage Percentage of $10.00, so no error is issued. |

30.00 |

Error for Reject Underage Percentage as the $10 underage is equal to the calculated amount for Reject Underage Percentage of $10. |

30.01 |

Would be an error as the $9.99 underage is greater than the Accept Underage Amount, but $9.99 is less than the calculation for Reject Underage Percentage of $10.00, so no error is issued. |

35.00 |

No error as $5 underage is less than the $5.01 Accept Underage Amount |

$45.00 |

No error as a $5 overage is less than $5.01 Accept Overage Amount. |

49.99 |

Would be an error as a $9.99 overage is equal to the Accept Overage Amount but $9.99 is less than the calculation for Reject Overage Percentage of $10.00, so no error is issued. |

$50.00 |

Error for Reject Overage Percentage as the $10 overage is equal to the calculated amount for Reject Overage Percentage of $10. |

$539.99 |

Error for Reject Overage Percentage as the $499.99 overage is greater than the calculated amount for Reject Overage Percentage of $10 but less than the Reject Overage Amount of $500.00. |

$540.00 |

Error for Reject Overage Amount as the $500 overage is equal to the Reject Overage Amount of $500.00 |

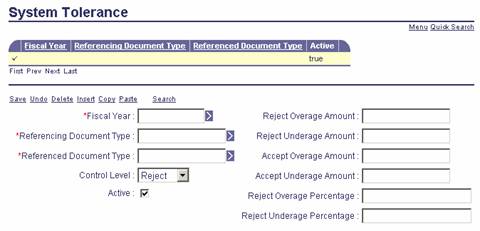

When tolerance rules should apply to all document codes between two document types on a system-wide basis for a fiscal year, the System Tolerance table provides such a control. The controls set here will always apply unless a particular fund code has a Fund Tolerance established to override the system tolerances. Such an override is useful when most funds should be controlled in one manner and one or more funds are the exception to the system wide rule.

The fields on the System Tolerance (STOL) table are as follows:

Field Name |

Field Description |

Fiscal Year |

A system wide tolerance is defined for a fiscal year to allow the ability to adjust tolerances between years, especially when a fiscal year has ended. |

Referencing Document Type |

A system wide tolerance requires the entry of a referencing document type defined on the Document Type table. |

Referenced Document Type |

A system wide tolerance requires the entry of a referenced document type defined on the Document Type table. |

Control Level |

A tolerance rule requires a choice of one of the three available control levels: Reject, Override, or Warning to define the severity of all tolerance error messages that can be issued from that tolerance record. |

Active |

An active flag provides the ability to turn off and on a tolerance without having to delete it (turn it off) and re-add it (turn it back on). |

Control Fields |

Please expand the ”Types of Tolerances” bullet for definitions. |

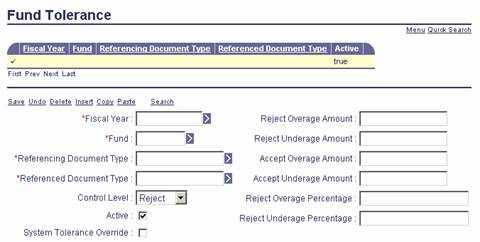

When tolerance rules should apply to all document codes between two document types for a single Fund code within a fiscal year, the Fund Tolerance table provides such a control. The controls set here will always apply unless a particular Fund code. The controls can be used to be more restrictive than existing system or document code tolerances, in which case the System Tolerance Override ability is not needed. However, if the fund code should have a tolerance that is less restrictive than the system tolerance, there is the ability to override the system tolerance so that no System Tolerance errors will be issued for the fund and fiscal year combination. Only Fund Tolerance errors and Document Code Tolerance errors can be issued in such a case.

The fields on the Fund Tolerance (FTOL) table are as follows:

Field Name |

Field Description |

Fiscal Year |

A fund wide tolerance is defined for a fiscal year to allow the ability to adjust tolerances between years, especially when a fiscal year has ended. |

Fund |

A fund wide tolerance is defined for a fiscal year and fund combination. Only valid fund codes defined within the fiscal year field on the Fund table are allowed. |

Referencing Document Type |

A fund tolerance requires the entry of a referencing document type defined on the Document Type table. |

Referenced Document Type |

A fund tolerance requires the entry of a referenced document type defined on the Document Type table. |

Control Level |

A tolerance rule requires a choice of one of the three available control levels: Reject, Override, or Warning to define the severity of all tolerance error messages that can be issued from that tolerance record. |

Active |

An active flag provides the ability to turn off and on a tolerance without having to delete it (turn it off) and re-add it (turn it back on). |

System Tolerance Override |

A flag to indicate to the application that when checked, system wide tolerance errors should not be issued for the fiscal year and fund combination. When unchecked, system wide tolerances will apply in addition to any fund tolerances. |

Control Fields |

Please expand the ”Types of Tolerances” bullet for definitions. |

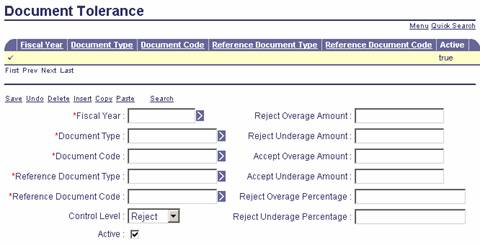

When tolerance rules should apply to specific document codes within a fiscal year, the Document Tolerance (DTOL) table provides such a control. The controls set here will always apply; therefore, multiple errors may be issued if a reference exceeds a document code and another type of tolerance. This is the only tolerance table that allows wildcard ability. The value of ALL is allowed in both document code fields so that multiple records do not have to be established when the rule is the same for all document codes referencing or all document codes being referenced. To use both wildcards at the same time is the equivalent of a system wide tolerance rule with the exception that a fund tolerance cannot override a Document Tolerance rule like it can override a System Tolerance rule.

The fields on the Document Tolerance (DTOL) table are as follows:

Field Name |

Field Description |

Fiscal Year |

A document tolerance is defined for a fiscal year to allow the ability to adjust tolerances between years, especially when a fiscal year has ended. |

(Referencing) Document Type |

A document tolerance requires the entry of a referencing document type defined on the Document Type table. |

(Referencing) Document Code |

A document tolerance requires the entry of a referencing document code defined on the Document Control table or the entry of the wildcard value of ALL. That wildcard is used when the rule should apply to all document codes in that document type. Other entries can be added for individual document codes in that document type when the tolerance rule should vary. Because of this the application will look for the specific rule 1st and then try the wildcard. |

Reference(d) Document Type |

A document tolerance requires the entry of a referenced document type defined on the Document Type table. |

Reference(d) Document Code |

A document tolerance requires the entry of a referenced document code defined on the Document Control table or the entry of the wildcard value of ALL. That wildcard is used when the rule should apply to all document codes in that document type. Other entries can be added for individual document codes in that document type when the tolerance rule should vary. Because of this, the application will look for the specific rule 1st and then try the wildcard. |

Control Level |

A tolerance rule requires a choice of one of the three available control levels: Reject, Override, or Warning to define the severity of all tolerance error messages that can be issued from that tolerance record. |

Active |

An active flag provides the ability to turn off and on a tolerance without having to delete it (turn it off) and re-add it (turn it back on). |

Control Fields |

Please expand the "Types of Tolerances” bullet for definitions. |